UPDATES & ANALYSIS

FEATURED POSTS

Iowa Court of Appeals April 2025 Published Opinion Roundup

The Iowa Court of Appeals selects certain opinions for publication in the Northwestern Reporter. In April, the Court of Appeals selected six opinions for publication. Following are summaries of those opinions.

Bitcoin ATM operator entitled to return of money seized by law enforcement, Iowa Supreme Court holds

Two Iowans who deposited cash into bitcoin automated teller machines, as they say they were instructed to do by scammers, will not receive their money back as a result of two Iowa Supreme Court rulings saying the owner of the ATM had the better argument that it was legally entitled to the cash seized by Linn County authorit …

Hispanic rights group lacks standing to challenge English-only voting materials, Iowa Supreme Court holds

An Iowa organization that advocates on behalf of Hispanic Iowans did not have legal standing to bring suit seeking to dissolve a 13-year-old injunction that barred the Secretary of State from disseminating voter registration materials in languages other than English, the Iowa Supreme Court held in a unanimous decision handed down May 9.

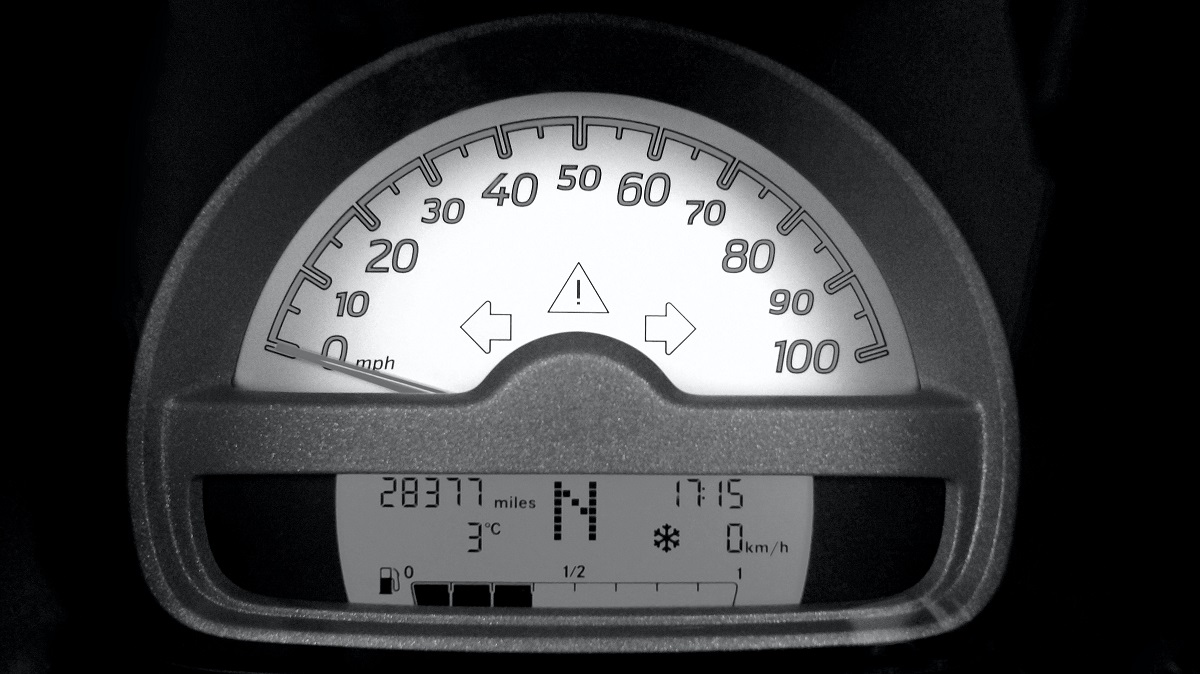

Iowa Supreme Court rejects bid to abolish exception to Fourth Amendment warrant requirement

A law enforcement officer making a roadside stop is legally allowed to search a vehicle without a warrant under an “automobile exception” to the protection against unreasonable searches and seizures granted by the Fourth Amendment of the U.S. Constitution and separately under the Iowa Constitution. That exception, recog …

EDITORIAL TEAM

ABOUT

On Brief: Iowa’s Appellate Blog is devoted to appellate litigation with a focus on the Iowa Supreme Court, the Iowa Court of Appeals, and the U.S. Court of Appeals for the Eighth Circuit.